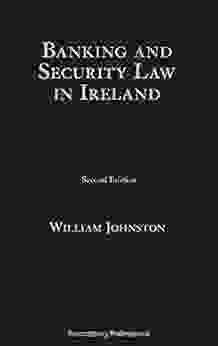

Banking and Security Law in Ireland: A Comprehensive Guide

Banking and security law play a crucial role in the Irish economy, governing the relationships between financial institutions, borrowers, and lenders. Understanding this legal framework is essential for individuals and businesses alike, as it provides the foundation for secure and responsible financial transactions. In this article, we will explore the various aspects of banking and security law in Ireland, including the regulatory landscape, the rights and obligations of parties involved in secured lending transactions, and the enforcement of security interests.

Regulatory Framework for Banking and Security Law in Ireland

The Central Bank of Ireland (CBI) is the primary regulator of the financial sector in Ireland. The CBI is responsible for ensuring the stability and integrity of the financial system, protecting consumers, and promoting competition. The CBI's regulatory framework for banking and security law includes:

5 out of 5

| Language | : | English |

| File size | : | 2327 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 1554 pages |

- The Central Bank Act 1942

- The Credit Institutions (Stabilization) Act 2010

- The European Union (Capital Requirements) Regulations 2013

- The European Union (Bank Recovery and Resolution) Regulations 2014

These regulations impose various requirements on financial institutions, including capital adequacy, liquidity management, and risk management. They also provide for the resolution of failing banks, protecting depositors and creditors to the extent possible.

Rights and Obligations of Borrowers and Lenders

When a borrower obtains a loan from a lender, the lender typically takes security over the borrower's assets to secure the repayment of the loan. The rights and obligations of borrowers and lenders are governed by the terms of the loan agreement and the relevant security documents.

Borrower's Rights:

- The right to receive a clear and concise explanation of the loan terms and security arrangements.

- The right to seek legal advice before signing any loan or security documents.

- The right to repay the loan early, without penalty (subject to any prepayment fees).

- The right to challenge the enforcement of a security interest if it is unfair or oppressive.

Lender's Obligations:

- The obligation to act fairly and reasonably in all dealings with the borrower.

- The obligation to disclose all material information about the loan and security arrangements to the borrower.

- The obligation to take reasonable steps to enforce the security interest only when necessary.

- The obligation to account to the borrower for any proceeds from the sale of secured assets.

Enforcement of Security Interests

In the event that a borrower defaults on a loan, the lender may enforce its security interest to recover the outstanding debt. The methods of enforcement available to the lender will depend on the type of security interest taken. Common methods of enforcement include:

- Sale of the secured asset

- Appointment of a receiver

- Possession of the secured asset

The enforcement of a security interest can have serious consequences for the borrower, including the loss of property or assets. It is therefore important for borrowers to seek legal advice if they are facing enforcement action.

Banking and security law in Ireland is a complex and ever-changing area of law. Understanding the legal framework governing financial transactions is essential for individuals and businesses alike. By being aware of their rights and obligations, borrowers and lenders can navigate the complexities of banking and security law with confidence.

If you are involved in a banking or security law matter, it is advisable to seek legal advice from an experienced professional. Legal professionals can assist you in understanding your rights and obligations, negotiating loan agreements and security documents, and representing you in any legal proceedings.

5 out of 5

| Language | : | English |

| File size | : | 2327 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 1554 pages |

Do you want to contribute by writing guest posts on this blog?

Please contact us and send us a resume of previous articles that you have written.

Book

Book Novel

Novel Page

Page Chapter

Chapter Text

Text Story

Story Genre

Genre Reader

Reader Library

Library Paperback

Paperback E-book

E-book Magazine

Magazine Newspaper

Newspaper Paragraph

Paragraph Sentence

Sentence Bookmark

Bookmark Shelf

Shelf Glossary

Glossary Bibliography

Bibliography Foreword

Foreword Preface

Preface Synopsis

Synopsis Annotation

Annotation Footnote

Footnote Manuscript

Manuscript Scroll

Scroll Codex

Codex Tome

Tome Bestseller

Bestseller Classics

Classics Library card

Library card Narrative

Narrative Biography

Biography Autobiography

Autobiography Memoir

Memoir Reference

Reference Encyclopedia

Encyclopedia Herbert J Carlin

Herbert J Carlin Mike Ferrell

Mike Ferrell Steven Erikson

Steven Erikson E H Carr

E H Carr Ellen B Grimes

Ellen B Grimes Edna Ma

Edna Ma Edwin B Holt

Edwin B Holt Eben Alexander Iii M D

Eben Alexander Iii M D Julie Carlson

Julie Carlson Henry Rollins

Henry Rollins Elizabeth Shown Mills

Elizabeth Shown Mills Elizabeth Dane

Elizabeth Dane Elizabeth Monroy

Elizabeth Monroy Elizabeth Hawes

Elizabeth Hawes John H O Neal

John H O Neal Edward Zigler

Edward Zigler Robert Vieira

Robert Vieira Richard Binder

Richard Binder Elizabeth Wissinger

Elizabeth Wissinger Edmund Lai

Edmund Lai

Light bulbAdvertise smarter! Our strategic ad space ensures maximum exposure. Reserve your spot today!

Leo TolstoyFollow ·13.8k

Leo TolstoyFollow ·13.8k Jamal BlairFollow ·11.6k

Jamal BlairFollow ·11.6k Colton CarterFollow ·17.9k

Colton CarterFollow ·17.9k Barry BryantFollow ·3.8k

Barry BryantFollow ·3.8k José MartíFollow ·8.1k

José MartíFollow ·8.1k Thomas MannFollow ·11.8k

Thomas MannFollow ·11.8k Stephen KingFollow ·3.3k

Stephen KingFollow ·3.3k Bobby HowardFollow ·18.9k

Bobby HowardFollow ·18.9k

Reginald Cox

Reginald CoxUnveiling the Extraordinary Life of It Israel Birthday...

A Captivating Narrative of...

Glenn Hayes

Glenn HayesUnveiling the Enchanting Tapestry of "Tales From The...

Are you ready to step...

Robert Louis Stevenson

Robert Louis StevensonUnlock the Incredible Mental Benefits of Berries:...

As the sun...

Edwin Cox

Edwin CoxUnlock the Secrets of Terrain with the Army Map Reading...

Embark on an adventure into the untamed...

5 out of 5

| Language | : | English |

| File size | : | 2327 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 1554 pages |